Hawthorne Residential provides high net worth individuals access to multifamily investments throughout the Sun Belt region of the United States.

Hawthorne Residential has an extensive track record of providing investors attractive risk-adjusted returns.

Learn More About Our Investment StrategyHow does an investment work?

Hawthorne Residential oversees the entire lifecycle of each investment, providing a 100% passive, turn-key investor experience.

Unlike a fund investment where you do not have discretion, each property (or portfolio of properties) that Hawthorne Residential acquires is a separate investment. As a result, you are able to review a property’s specific investment details prior to investing.

Our approach in action

Historical Benefits of Apartment Investments*

Return Potential

Potential for an attractive, risk-adjusted return that historically provides inflation protection and a low correlation to stocks and bonds.

Less Volatility

With usually over 200+ residents, multifamily provides a more diversified tenant base, typically resulting in less volatility than office, retail, or industrial which has fewer, larger tenants.

Resilience

Given the importance of housing, multifamily has historically been one of the most resilient property types during a recession.

Less Capital Intensive

Multifamily properties are typically less capital intensive than retail, office or industrial due to the lack of significant tenant leasing and upfit cost.

*Footnote: Apartment investments are speculative and involve a significant degree of risk and lack of liquidity. You should not construe this information as legal, tax, investment, or other advice. You must make your own inquiries and should consult your own advisors as to the appropriateness and desirability of any investments.

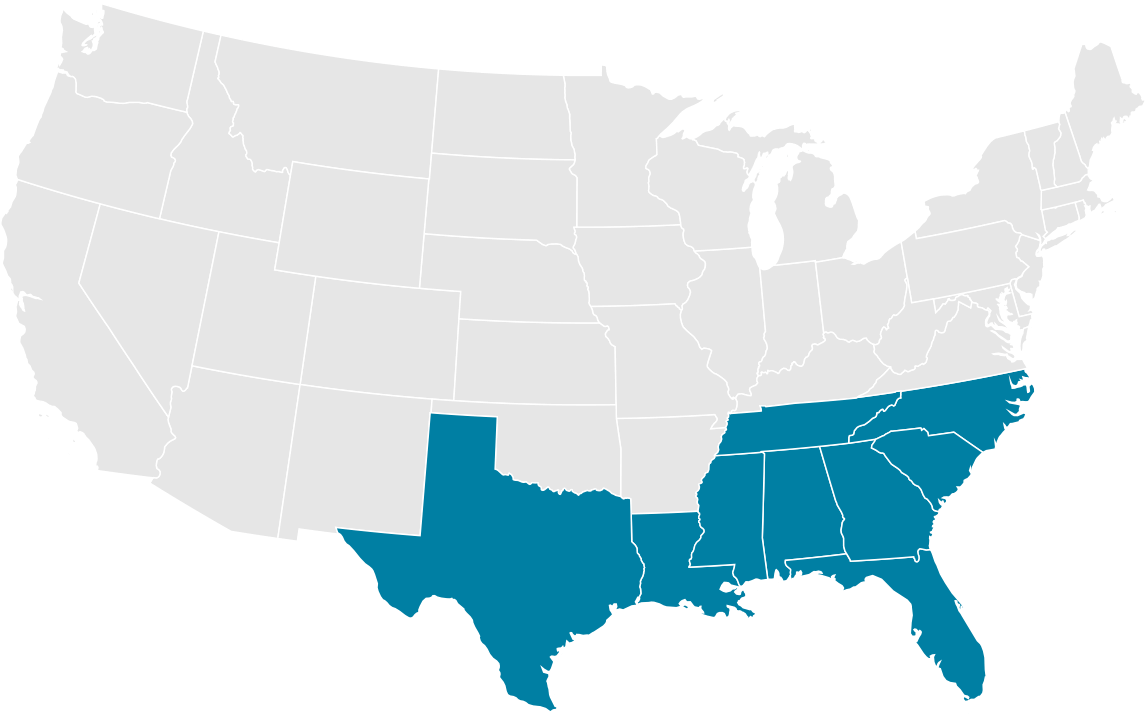

Why Invest in the Sun Belt?

- The 18 state Sun Belt region stretches across the Southeast and Southwest and includes seven of the 10 largest US cities.*

- Over the past decade, the Sun Belt accounted for 75% of the total US population growth.*

- Over the next decade, the population in the Sun Belt is expected to increase by 13% vs 3% for non Sun Belt states.*

- Population and employment growth in the Sun Belt is driven by the region’s mild weather, favorable tax environment, pro-business climate, quality of life and lower cost of living.*

*Footnote: Moody's Analytics. Q1 2019.

Who can invest?

Investments offered by affiliates of Hawthorne Residential are only offered to Accredited Investors as defined by Rule 501 of Regulation D of the U.S. Securities and Exchange Commission.

For information, please visit the U.S. Securities and Exchange Commission’s website.

*Footnote: Accreditated Investors- Updated Investor Bulleton | Investor.gov.

Testimonials